In today’s ever evolving fintech landscape, the battle for users’ attention is fierce. As we strive to transform banking into a source of both security and joy, we discover ourselves at the crossroads of creativity and technology. Design thinking has emerged as a powerful tool in this endeavour, offering a user-centric approach that can revolutionize the way we conceptualize and build internet and mobile banking applications. In this article, we explore the principles of design thinking and how they were harnessed to create a user-focused fintech solution.

How does design thinking play a role in the financial industry and why is it important for creating user-centric experiences?

Design thinking plays a pivotal role in the financial industry by placing the user at the centre of the product development process. In an era where having superior customer experience can be a competitive advantage, design thinking helps in building user-centric financial products and services that are intuitive and easy to use, leading to increased user satisfaction and loyalty.

What are the key steps in the design thinking process that fintech companies should follow to improve their products and services?

The design thinking process consists of five key steps: empathize, define, ideate, prototype, and test. Fintech companies should start by empathizing with their users to understand their financial challenges. Next, they should define the specific problems they aim to solve. Then, ideation comes into play, where creative solutions are brainstormed. After that, prototypes are developed and tested with users for feedback and validation.

How can fintech startups, with limited resources, incorporate design thinking into their product development and design processes?

Fintech startups with limited resources can still embrace design thinking by focusing on a lean approach. They can start by conducting user interviews and surveys to empathize with their target audience without significant costs. Your target audience could be part of your organisation. Before you recruit users outside for testing, try staff, then current customers and then future customers.

Collaborating with cross-functional teams and seeking feedback from the earliest stages of product development is crucial. Using low-cost prototyping tools and conducting usability tests can help in refining their solutions efficiently. The key is to maintain a user-centric mindset even with resource constraints.

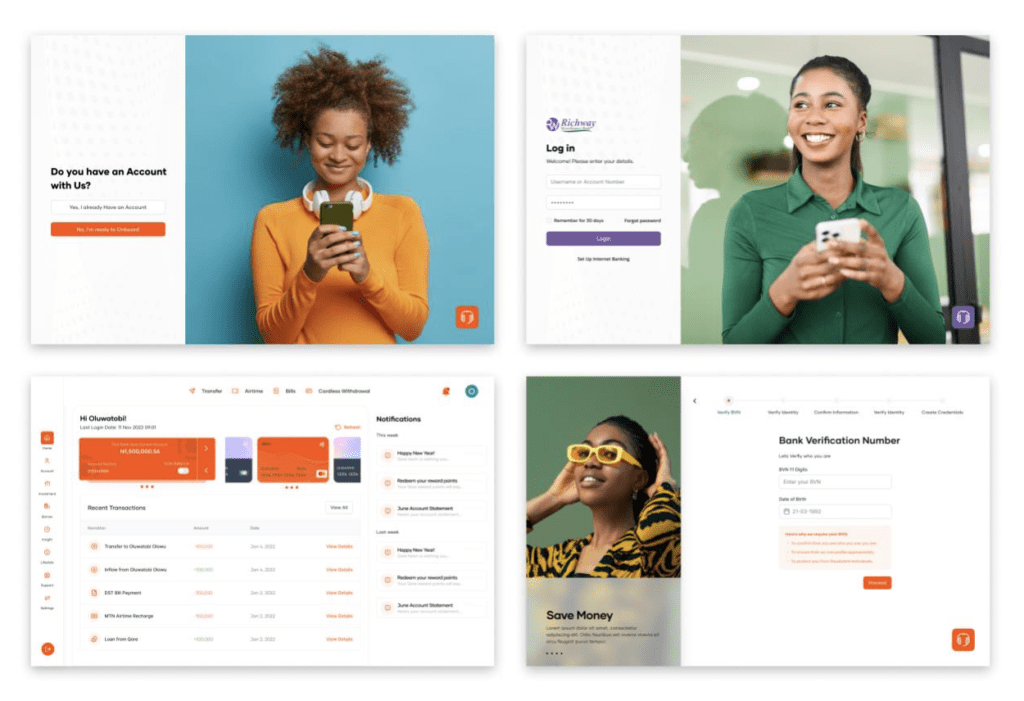

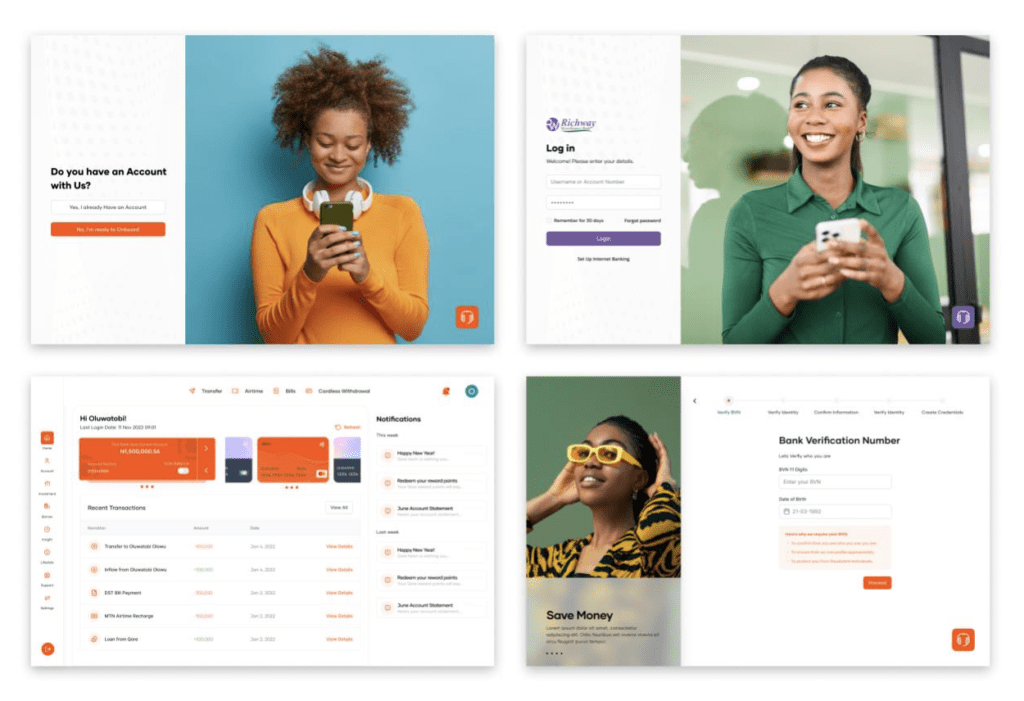

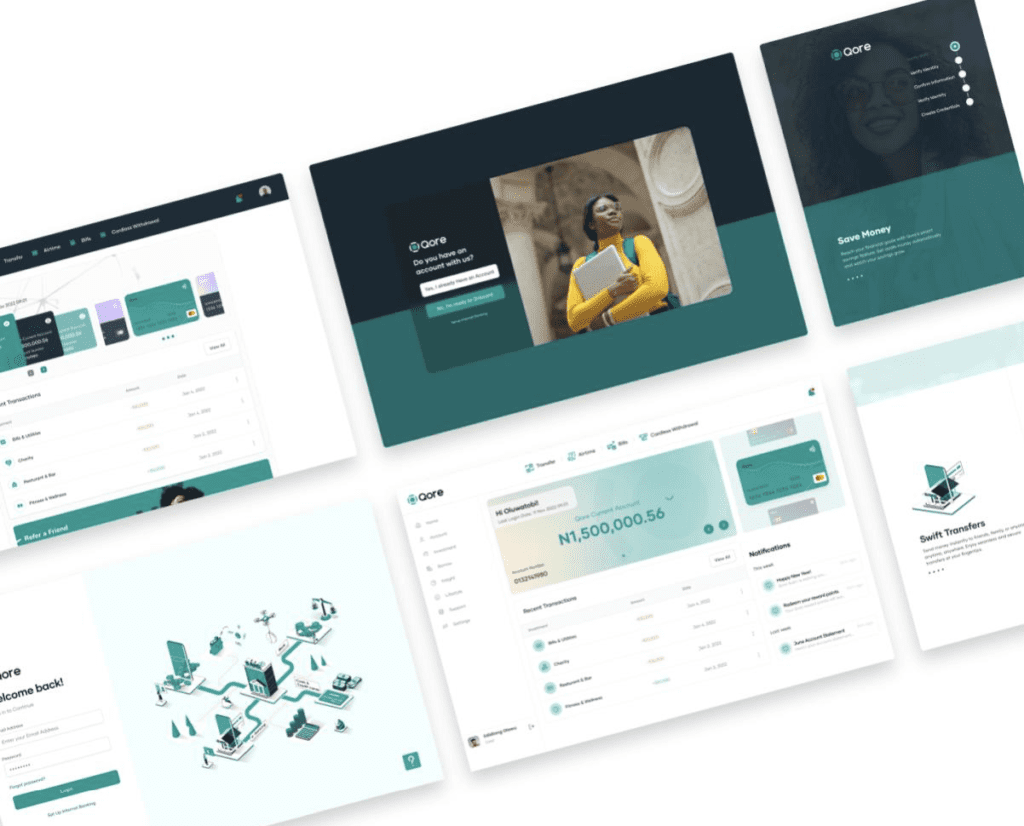

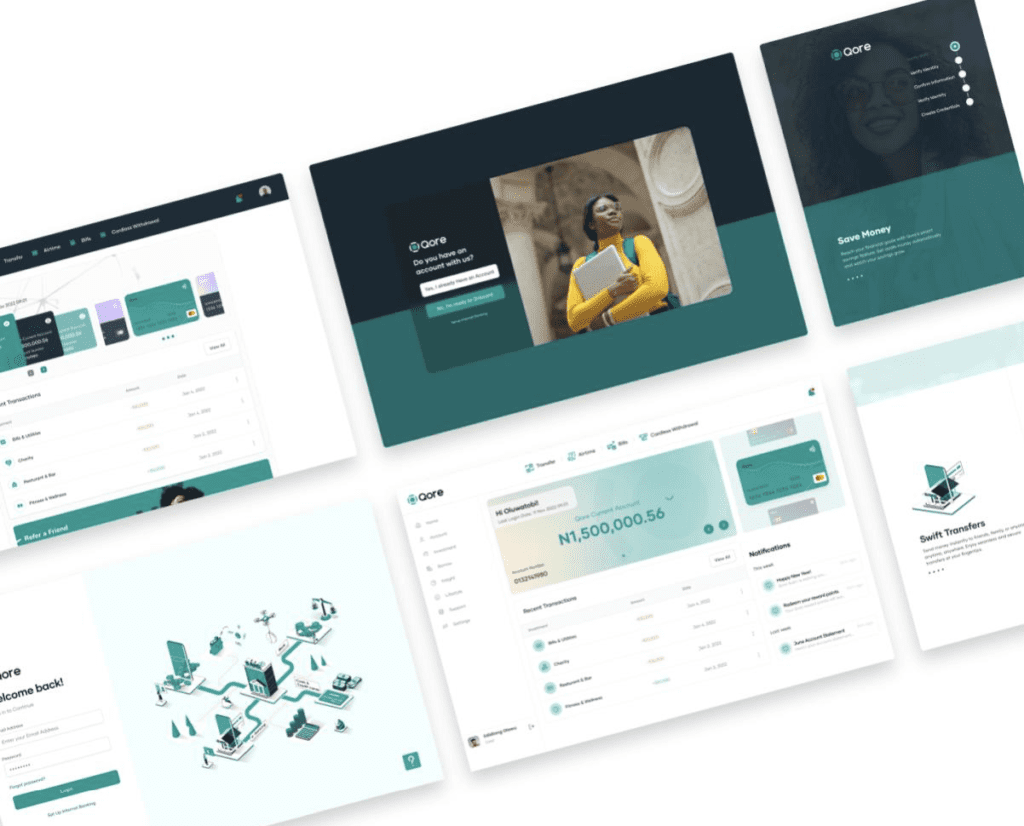

The Birth of a User-Centric Banking App: A Case Study

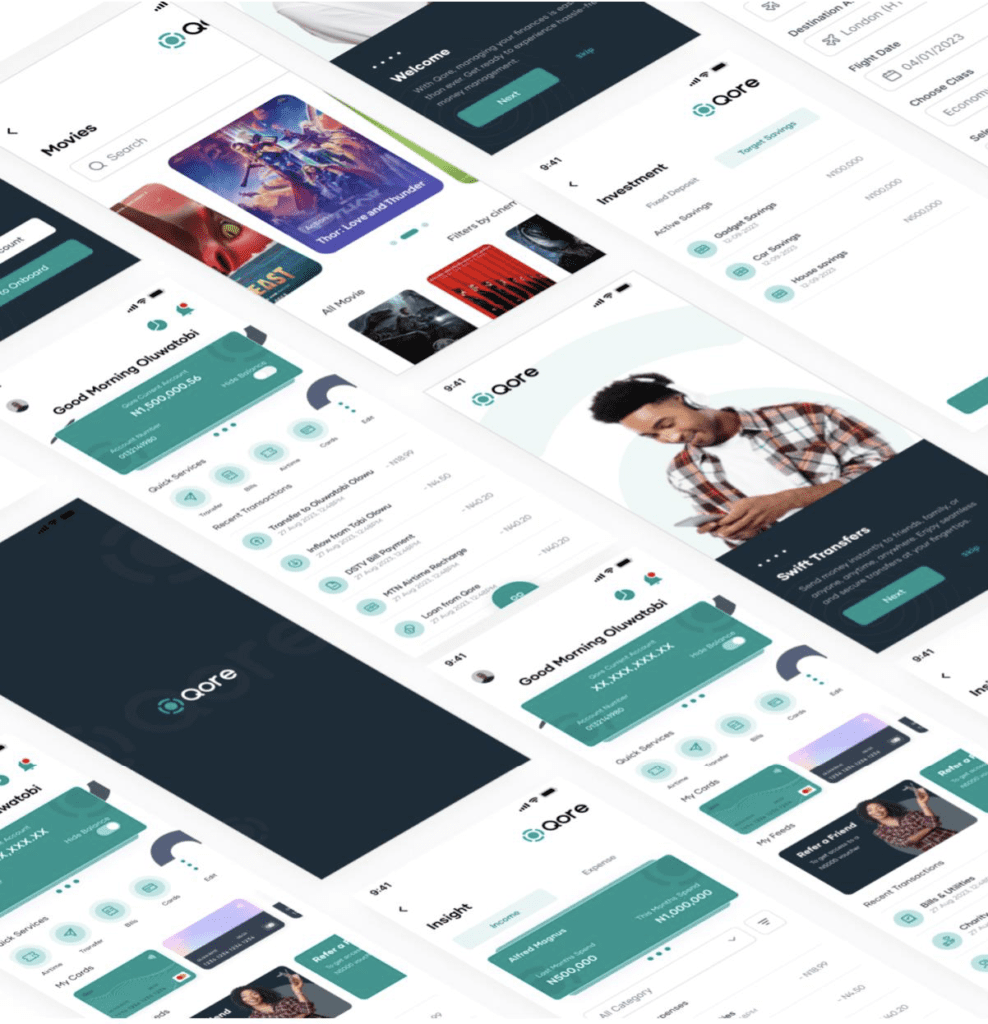

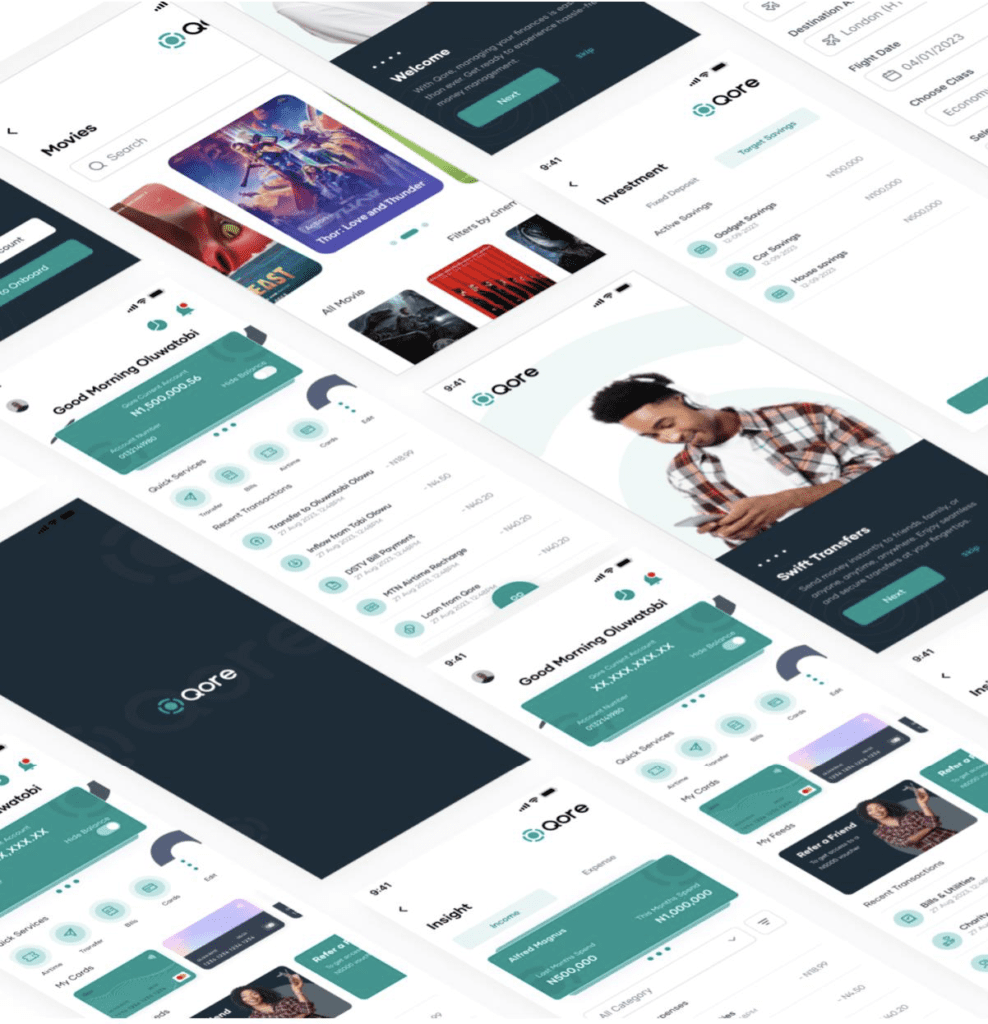

Designing a user-focused internet and mobile banking solution, featuring an intuitive interface, streamlined transfers, bill payment, personal finance tracking, and lifestyle features.

How did we get here?

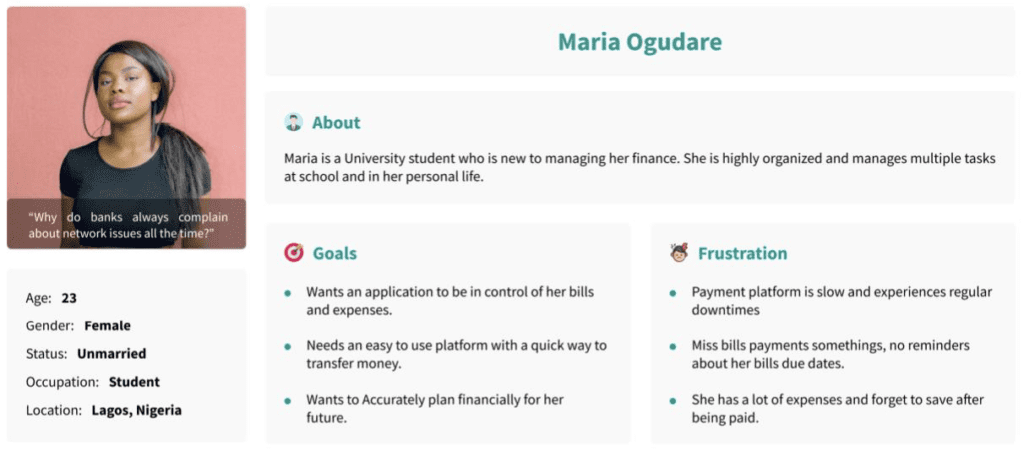

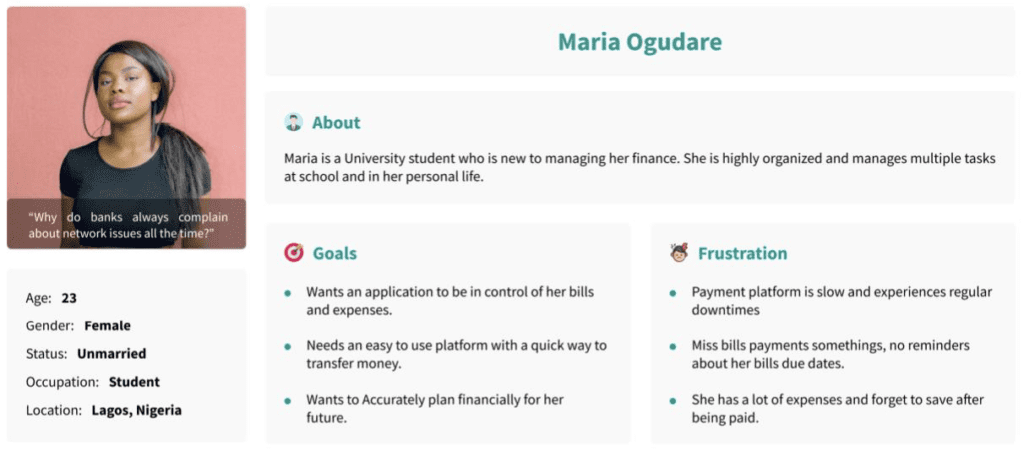

In designing the App, we used a lean approach as described above. We gathered feedback from our current users using the interview and survey methods. From the research, these were some of our findings which informed the decisions and features for the new App.

- Many users expressed dissatisfaction with the complexity and cluttered interfaces of existing app.

- Many users also suggested a streamlined and simple onboarding process on the App.

- Users had varied methods for managing their budgets, indicating the need for personalized financial tracking tools.

- Desired features included simplified, engaging, and latest interface standards, robust budgeting tools, and secure and user-friendly transfer processes.

These feedbacks helped us create useful User personas which served as a reference point during the whole design thinking process.

In adopting Lean UX principles, this project emphasized close collaboration among designers, developers, product managers, and stakeholders. The close collaboration was achieved through Daily stand-up meetings and regular workshops, including “How Might We” (HMW) sessions, involving the entire cross-functional team.

We prioritized the creation of both Minimum Viable Products (MVPs) and prototypes, adopting an approach aligned with evolutionary prototyping principles. This approach allowed us to swiftly test our ideas, validate assumptions, and gather user feedback early in the design process. Our prototypes were put through series of iterative refinement, integrating insights derived from user testing sessions and stakeholder validations. This rapid prototyping approach helped in refining the product features efficiently.

In our project, user feedback was integral to the design process. We conducted frequent usability testing sessions, involving real users interacting with prototypes. The insights gained informed rapid adjustments to the user interface, user flows, and overall design. This iterative feedback loop ensured that the final product was not only user-friendly but also aligned with the evolving needs of our target audience.

Rather than solely concentrating on traditional design documentation outputs, our team shifted its focus to measurable outcomes. Success was defined by the achievement of a desirable user experience and the overall effectiveness of the App.

The Lean UX methodology played a critical role in the success of our internet and mobile banking solution project. Through cross-functional collaboration, creating MVPs, prototyping, continuous testing, and a focus on outcomes, we not only streamlined the design process but also delivered a user-focused product that met the evolving needs of our target audience.

How can design thinking help fintech companies address financial literacy and inclusion, especially for underserved or unbanked populations?

Design thinking can play a vital role in addressing financial literacy and inclusion challenges by helping us understand the unique needs and constraints of underserved populations. Fintech companies can design intuitive interfaces and educational tools that simplify financial concepts. Moreover, they can create solutions that work well in low-resource environments and offer services in local languages. For example, the USSD for transactions is a perfect solution for the underbanked, it provides means of banking using prompt-based interaction. All banks and some FinTech companies have USSD in Nigeria, including NIBBS with MCASH. The ability to access financial service with just a 2g network is laudable. These are the initiative we have right now.

Taking it a double notch will be accessibility, considering those kinds of users and include use of different languages, less complex language in our apps, solving their specific problem with products suited for them. This approach not only enhances financial literacy but also promotes financial inclusion by making banking services accessible to a broader demographic.

Conclusion

Design thinking, as exemplified in our journey, offers a robust framework for crafting user-centric internet and mobile banking applications. By placing the user at the heart of the design and development process, we can create solutions that are not only secure and efficient but also intuitive, visually pleasing, and tailored to diverse financial needs. As we continue to innovate, the principles of design thinking will remain our guiding light in the quest to make banking a more delightful experience for all.

Tomorrow is automated

Let’s discuss how our products can give your business the boost it needs.